Matt Gray, 03 May 2018

Several financial institutions have recently announced they will stop funding new coal power projects, with HSBC being the latest. This blog details why announcements about new coal investments are wholly inadequate to comply with the Paris Agreement and how investors can focus on retiring existing coal.

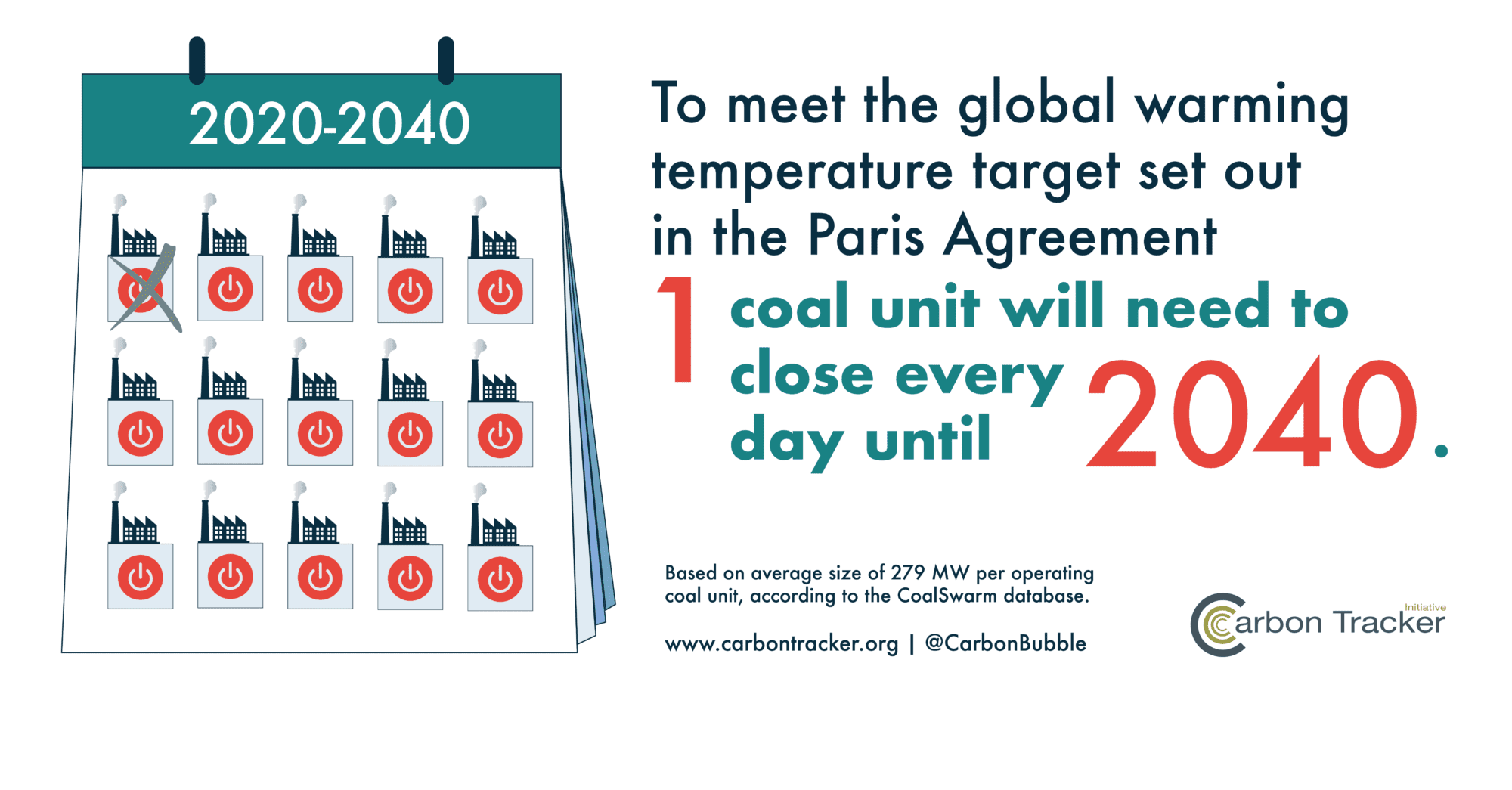

To meet the temperature goal in the Paris Agreement, on average, one coal unit will need to close every day until 2040.

The maths behind this statement is simple. There is currently around 2,000,000 megawatts (MW) of unabated coal capacity in operation. After accounting for retirements and additions, we expect there to be around the same amount of capacity in operation by 2020. As detailed in the IEA’s “beyond 2-degree” scenario, coal generation without carbon capture and storage (CCS) is totally phased-out by 2040. According to the CoalSwarm database, operating coal units are currently on average 297 MW. This equals to around one coal unit every day until 2040 which needs to be retired, retrofitted with CCS, or converted to biomass to meet the Paris goals.

For perspective: from 2010 to 2017, around 240,000 MW was retired with an average unit age of 46 years. In short, there needs to be a near threefold increase in the amount of capacity closed to meet the temperature goal in Paris. The average age of the existing fleet is currently 22 years, meaning many closures will cause painful impairments like those experienced by EU utilities.

Announcements from investors about halting new coal investments are tantamount to shuffling chairs on the Titanic, due to their failure to acknowledge the scale of the existing coal problem. HSBC’s announcement is a case in point. Truth be told, those investors who are still financing new coal capacity are either getting rent-seeking subsidies or are due a rude awakening as economic forces and public awareness put coal in a death spiral.

To remain consistent with Paris and to understand the financial risk associated with coal power, investors need to demand asset-level retirement schedules from unit operators.

Power markets with operating coal capacity can be broadly categorised three ways: (i) regulated markets where coal is subsidised and largely immune to economics (for e.g., many regions of the US); (ii) liberalised markets where coal is increasingly unviable due to economics (for e.g., the EU); and (iii) other markets (both regulated and liberalised) where governments are yet to introduce effective policies to drive down the cost of renewable energy (for e.g. reverse auctions in India have led to considerable declines in the cost of solar).

Asset economics, air pollution and carbon pricing will force governments to address outdated policy frameworks in regulated markets. Unit operators in liberalised markets will bleed cash over the decades as low-cost variable renewable energy and other more flexible resources keep power prices low and take market share. Laggard governments in other markets will be forced to introduce effective reverse auctions or risk undermining their economic competitiveness and missing out on a significant export market.

Investors can accelerate these trends by demanding retirement schedules which reflect market conditions. Carbon Tracker’s approach seeks to replicate real-world investment decisions by modelling the asset economics of every operating unit.[1] Investment announcements that ignore existing coal capacity not only underplay the scale of the challenge and the associated financial risks, but also patronise those communities already adversely impacted by human-induced climate change.

Matt Gray – Analyst (Power & Utilities)

[1] For more information, please contact the author: mgray@carbontracker.org

Đăng nhận xét