Tan Hao, 13.06.2018

Energy-intensive manufacturing is slowly returning to the US from China. It’s a positive move for the environment, writes Tan Hao

By taking measures to restrict its exports of products such as steel and aluminium, China could reduce excess production and environmental degradation (Image: zhaojiankang)

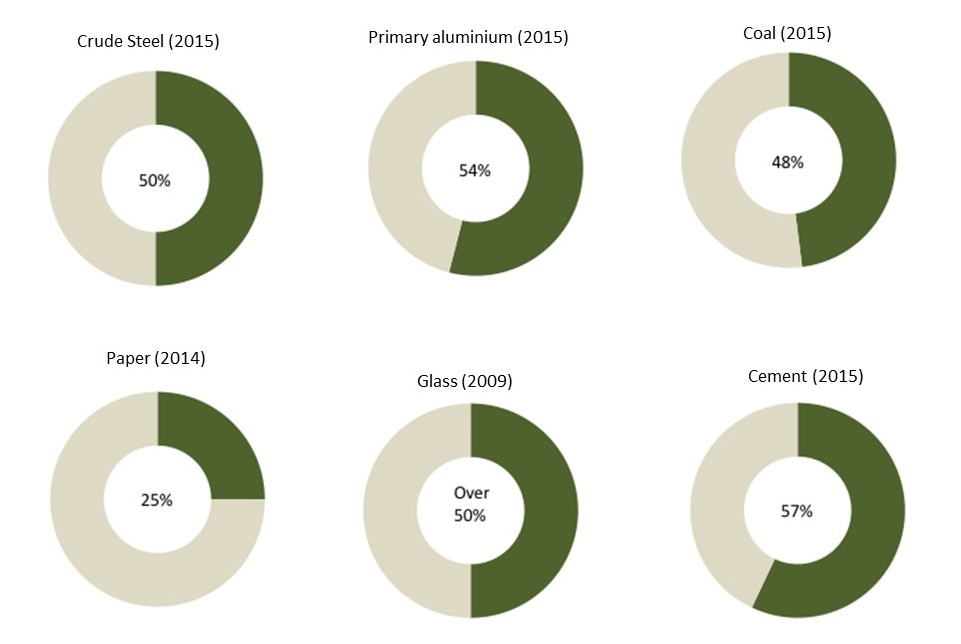

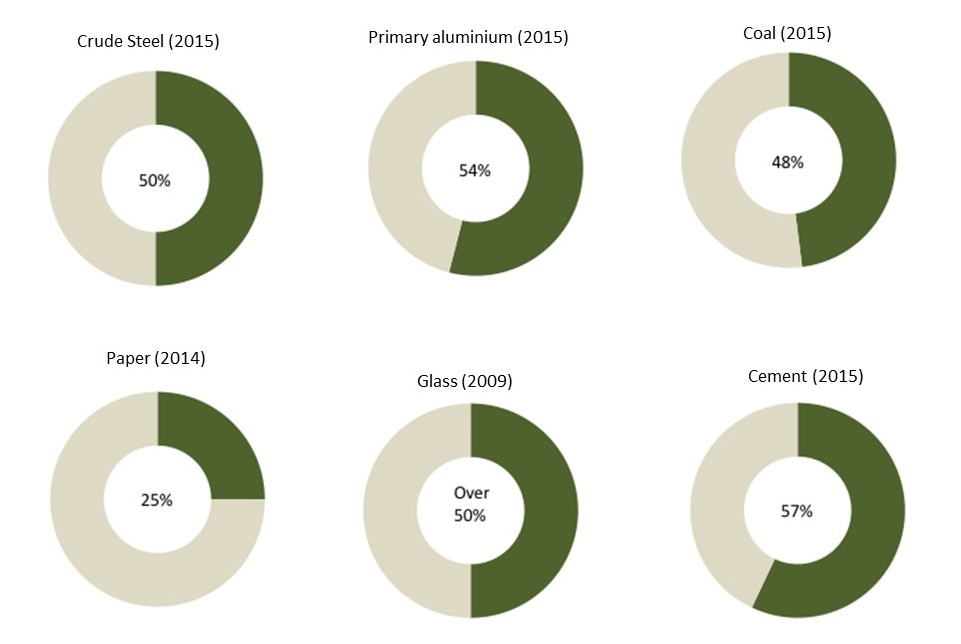

China now produces more steel, aluminium, glass and cement than the rest of the world combined. This global concentration of energy-intensive manufacturing has been at the centre of China’s rapid industrialisation and its positioning as the world’s factory in the course of recent decades. It has also stemmed from the de-industrialisation that has occurred concurrently in many Western countries.

Rebalancing global industry, that is, relocating certain energy-intensive industries from China to more technologically advanced countries, would benefit both China and the world. The relocation of energy-intensive production has environmental benefits and is economically viable, as illustrated by a number of recent investments in the United States by Chinese firms. It also reverses the trend of recent decades, which has resulted in the global concentration of manufacturing in China.

Rebalancing global industry, that is, relocating certain energy-intensive industries from China to more technologically advanced countries, would benefit both China and the world. The relocation of energy-intensive production has environmental benefits and is economically viable, as illustrated by a number of recent investments in the United States by Chinese firms. It also reverses the trend of recent decades, which has resulted in the global concentration of manufacturing in China.

China’s share of world production in selected industries

Source: Compiled by author based on data from the World Steel Association (for steel), the US Geographical Survey (for aluminium and cement), the BP Statistical Review of World Energy (for coal), Wintour (2014) (for glass), and statistica.com (for paper).

Source: Compiled by author based on data from the World Steel Association (for steel), the US Geographical Survey (for aluminium and cement), the BP Statistical Review of World Energy (for coal), Wintour (2014) (for glass), and statistica.com (for paper).

Yet today, excessive production and export of many energy-intensive products in China, such as steel, aluminium and glass, is becoming increasingly problematic for the country and for the world. These Chinese industries are plagued by rising costs and shrinking demand, and they bear heavy responsibility for high levels of air, water and soil pollution, which have accompanied China’s emergence as the world’s leading producer of greenhouse gases. Overcapacity in these sectors has been widely recognised by the Chinese government, industries and the public.

Despite the protectionist measures currently being imposed by some countries, fundamental economic and political changes, occurring in China and in Western countries, will have more long-lasting effects on trade and the global industrial structure. Shifting economics in energy-intensive industries and domestic political considerations are driving the relocation of manufacturing activities in those industries from China to developed countries, in particular the US. The result of this is what I call “a global industrial rebalance.” Such a rebalance will benefit the global environment thanks to differences in energy efficiency across countries.

Energy-intensive production in China and the challenges this poses

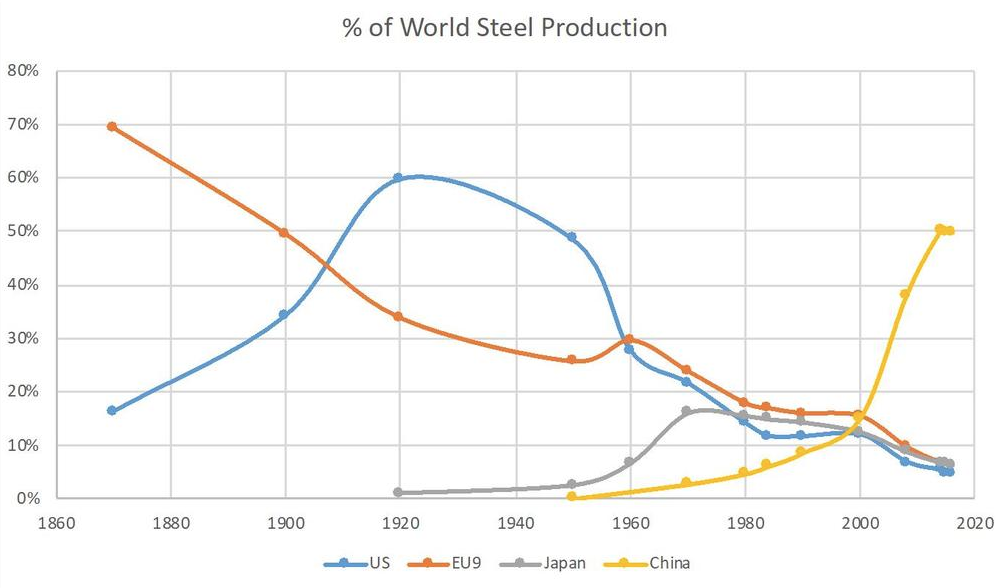

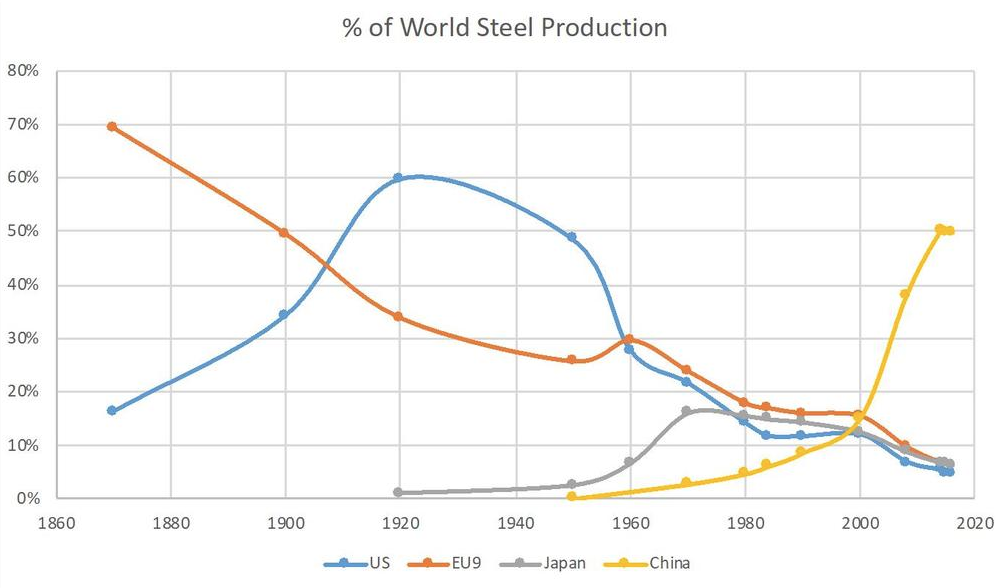

Since the 1980s, China has emerged as a major producer in a number of heavy industries, including steel and aluminium. Chinese steel output expanded from 10% to 50% of the global total between 1990 and 2015. It has also grown in other new industrialising countries such as India, which currently contributes about 6% of the global total . But China’s steel production has outstripped that of all other countries.

Shares of world steel production by countries (1870-2016)

Source: Compiled by author based on data available in Tarr (1988) (up to 1984) and from the World Steel Association (since 1984).

The rapid growth of China’s heavy industries, such as steel and aluminium, played an important role in the country’s industrialisation. However, the continuous growth of production in these industries in China is increasingly recognised as being unsustainable, and they have struggled financially in recent years.

According to official Chinese statistics, steel was the least profitable of all Chinese manufacturing industries for six consecutive years between 2011 and 2016, with profitability ranging between -2.2% and 2.9%. In 2015, the industry as a whole lost 78 billion yuan (US$12 billion). The profitability of aluminium was not much better, below 4% in a majority of recent years.

The poor financial performance of those industries has been due to intensifying competition resulting from excess capacity and fast-growing production costs. The latter has particularly been driven by rising costs of labour and more rigorous enforcement of environmental laws as both official and popular concern about the climate crisis and local pollution grows.

While many environmental policies and laws introduced in China in the 1980s and 1990s were regarded as “paper tigers”, enforcement of environmental laws has been strengthened in recent years. For example, authorities launched a number of so-called “environmental protection storms” during which many steel plants that did not meet environmental standards were forced to upgrade their technologies, or in some cases were shut down.

Facing an increasingly saturated domestic market, Chinese companies have set their sights upon the international market. Over the ten years since 2005, exports of Chinese steel products increased more than 500%, from 20 million tonnes in 2005 to 112 million tonnes in 2015. Exports of Chinese aluminium products quadrupled during the same period, from one million tonnes to four million tonnes.

Chinese exports of energy-intensive goods, particularly steel, have become a major subject of international trade disputes, with a record number of investigations of Chinese steel launched by its trading partners in 2016. Among 119 anti-dumping and anti-subsidy investigations in that year, 49 concerned Chinese steel products. Consequently, exports of Chinese steel fell to under 100 million tonnes in 2016, and 75 million tonnes in 2017.

The few, if any, financial gains for China’s energy-intensive industries come at a significant cost for the rest of the country. A 2014 study by researchers from Tsinghua University, for instance, found that coal, a main ingredient in energy-intensive production in China, would be 40% more expensive if local social and environmental costs were taken into account, even without considering costs associated with climate change as a result of carbon emissions. This comes at a time when Chinese citizens and officials alike are pressing to improve the country’s environmental record. According to a 2015 online survey by China Daily, air pollution was the single most important issue concerning the Chinese public, even ranking above corruption and the wealth gap.

Source: Compiled by author based on data from the World Steel Association (for steel), the US Geographical Survey (for aluminium and cement), the BP Statistical Review of World Energy (for coal), Wintour (2014) (for glass), and statistica.com (for paper).

Source: Compiled by author based on data from the World Steel Association (for steel), the US Geographical Survey (for aluminium and cement), the BP Statistical Review of World Energy (for coal), Wintour (2014) (for glass), and statistica.com (for paper).Yet today, excessive production and export of many energy-intensive products in China, such as steel, aluminium and glass, is becoming increasingly problematic for the country and for the world. These Chinese industries are plagued by rising costs and shrinking demand, and they bear heavy responsibility for high levels of air, water and soil pollution, which have accompanied China’s emergence as the world’s leading producer of greenhouse gases. Overcapacity in these sectors has been widely recognised by the Chinese government, industries and the public.

Despite the protectionist measures currently being imposed by some countries, fundamental economic and political changes, occurring in China and in Western countries, will have more long-lasting effects on trade and the global industrial structure. Shifting economics in energy-intensive industries and domestic political considerations are driving the relocation of manufacturing activities in those industries from China to developed countries, in particular the US. The result of this is what I call “a global industrial rebalance.” Such a rebalance will benefit the global environment thanks to differences in energy efficiency across countries.

Energy-intensive production in China and the challenges this poses

Since the 1980s, China has emerged as a major producer in a number of heavy industries, including steel and aluminium. Chinese steel output expanded from 10% to 50% of the global total between 1990 and 2015. It has also grown in other new industrialising countries such as India, which currently contributes about 6% of the global total . But China’s steel production has outstripped that of all other countries.

Shares of world steel production by countries (1870-2016)

Source: Compiled by author based on data available in Tarr (1988) (up to 1984) and from the World Steel Association (since 1984).

The rapid growth of China’s heavy industries, such as steel and aluminium, played an important role in the country’s industrialisation. However, the continuous growth of production in these industries in China is increasingly recognised as being unsustainable, and they have struggled financially in recent years.

According to official Chinese statistics, steel was the least profitable of all Chinese manufacturing industries for six consecutive years between 2011 and 2016, with profitability ranging between -2.2% and 2.9%. In 2015, the industry as a whole lost 78 billion yuan (US$12 billion). The profitability of aluminium was not much better, below 4% in a majority of recent years.

The poor financial performance of those industries has been due to intensifying competition resulting from excess capacity and fast-growing production costs. The latter has particularly been driven by rising costs of labour and more rigorous enforcement of environmental laws as both official and popular concern about the climate crisis and local pollution grows.

While many environmental policies and laws introduced in China in the 1980s and 1990s were regarded as “paper tigers”, enforcement of environmental laws has been strengthened in recent years. For example, authorities launched a number of so-called “environmental protection storms” during which many steel plants that did not meet environmental standards were forced to upgrade their technologies, or in some cases were shut down.

Facing an increasingly saturated domestic market, Chinese companies have set their sights upon the international market. Over the ten years since 2005, exports of Chinese steel products increased more than 500%, from 20 million tonnes in 2005 to 112 million tonnes in 2015. Exports of Chinese aluminium products quadrupled during the same period, from one million tonnes to four million tonnes.

Chinese exports of energy-intensive goods, particularly steel, have become a major subject of international trade disputes, with a record number of investigations of Chinese steel launched by its trading partners in 2016. Among 119 anti-dumping and anti-subsidy investigations in that year, 49 concerned Chinese steel products. Consequently, exports of Chinese steel fell to under 100 million tonnes in 2016, and 75 million tonnes in 2017.

The few, if any, financial gains for China’s energy-intensive industries come at a significant cost for the rest of the country. A 2014 study by researchers from Tsinghua University, for instance, found that coal, a main ingredient in energy-intensive production in China, would be 40% more expensive if local social and environmental costs were taken into account, even without considering costs associated with climate change as a result of carbon emissions. This comes at a time when Chinese citizens and officials alike are pressing to improve the country’s environmental record. According to a 2015 online survey by China Daily, air pollution was the single most important issue concerning the Chinese public, even ranking above corruption and the wealth gap.

Export-related production from China accounted for 15% of the country’s emissions of PM2.5, a deadly industrial by-product that kills 157,000 Chinese each year.

Exports of energy-intensive goods are creating ever greater environmental problems and other challenges for China. One 2015 study indicated that export-related production from China accounted for 15% of the country’s emissions of PM2.5, a deadly industrial by-product that kills 157,000 Chinese each year. Exports also account for around 20% of the country’s carbon dioxide emissions – a substantial amount, given that China is the world’s largest carbon emitter.

China’s steel industry uses more energy than any other domestic industry. Production of steel, aluminium, cement and glass accounts for approximately one fourth of total energy consumption in the country. China needs to greatly reduce production in those energy-intensive industries in order both to combat local pollution and to fulfil its commitment as part of the Paris Agreement to reach peak carbon emissions by 2030.

The Chinese government has initiated some steps in this direction, announcing plans to cut steel production capacity by 100 to 150 million tonnes over the 13th Five-Year plan period (2016-2020), and to significantly reduce production in other energy-intensive industries, such as cement, aluminium, and glass.

Some recent plant closures, such as those in Hangzhou and Sichuan, have drawn intense scrutiny from international media. In April 2017, the Chinese government announced a plan to create a massive “special economic zone” called the Xiong’an New Area in Hebei province. Hebei is the heartland of China’s steel industry, currently producing almost one-quarter of the crude steel output in the country. To establish Xiong’an, which the government has billed as a “world-class, green, modern and smart city,” many of the old, polluting steel mills will reportedly be dismantled. For example, Baoding, a city in Hebei near Xiong’an New Area, announced in 2017 that it had become a “steel production free” city after closing substantial steel production capacity.

Relocation of energy-intensive manufacturing

At the same time that China is looking to reduce its energy-intensive production, US energy-intensive manufacturing is becoming more economically viable thanks to the recent revolution in shale gas production.

Shale gas production through fracking technologies in the United States and other developed countries has confronted powerful, but largely abortive, anti-fracking movements that denounce the environmental consequences of fracking. Nevertheless, soaring shale gas output has effectively brought down energy costs of manufacturing in the US.

Energy is a significant portion of total production costs in energy-intensive industries, for example, up to 40% in steel making, and 14-40% in glass production, depending on plant location. Today, the price of liquefied natural gas (LNG) is 70% lower in the US than in China, and electricity for industrial consumers is almost 40% cheaper, making energy-intensive manufacturing in the US increasingly attractive.

Some companies are taking note. In 2017, one of Taiwan’s largest steel companies announced that it had abandoned a plan to invest in Vietnam, and instead planned to invest US$1.6 billion to build a steel factory in the US. The largest auto glass producer in China, Fuyao Glass, recently made a US$1-billion investment in Ohio. This trend is further illustrated by Chinese manufacturers’ recent investments in other energy-intensive industries, such as paper and aluminium, in the US.

The Chinese government has initiated some steps in this direction, announcing plans to cut steel production capacity by 100 to 150 million tonnes over the 13th Five-Year plan period (2016-2020), and to significantly reduce production in other energy-intensive industries, such as cement, aluminium, and glass.

Some recent plant closures, such as those in Hangzhou and Sichuan, have drawn intense scrutiny from international media. In April 2017, the Chinese government announced a plan to create a massive “special economic zone” called the Xiong’an New Area in Hebei province. Hebei is the heartland of China’s steel industry, currently producing almost one-quarter of the crude steel output in the country. To establish Xiong’an, which the government has billed as a “world-class, green, modern and smart city,” many of the old, polluting steel mills will reportedly be dismantled. For example, Baoding, a city in Hebei near Xiong’an New Area, announced in 2017 that it had become a “steel production free” city after closing substantial steel production capacity.

Relocation of energy-intensive manufacturing

At the same time that China is looking to reduce its energy-intensive production, US energy-intensive manufacturing is becoming more economically viable thanks to the recent revolution in shale gas production.

Shale gas production through fracking technologies in the United States and other developed countries has confronted powerful, but largely abortive, anti-fracking movements that denounce the environmental consequences of fracking. Nevertheless, soaring shale gas output has effectively brought down energy costs of manufacturing in the US.

Energy is a significant portion of total production costs in energy-intensive industries, for example, up to 40% in steel making, and 14-40% in glass production, depending on plant location. Today, the price of liquefied natural gas (LNG) is 70% lower in the US than in China, and electricity for industrial consumers is almost 40% cheaper, making energy-intensive manufacturing in the US increasingly attractive.

Some companies are taking note. In 2017, one of Taiwan’s largest steel companies announced that it had abandoned a plan to invest in Vietnam, and instead planned to invest US$1.6 billion to build a steel factory in the US. The largest auto glass producer in China, Fuyao Glass, recently made a US$1-billion investment in Ohio. This trend is further illustrated by Chinese manufacturers’ recent investments in other energy-intensive industries, such as paper and aluminium, in the US.

Steel manufacturing in China on average emits 24% more carbon than that in the US and 26% more than in Germany

In addition to becoming more price competitive, energy-intensive production is likely to be cleaner in developed countries than in China. Steel manufacturing in China on average emits 24% more carbon than that in the US and 26% more than in Germany, because electric arc furnaces (EAFs), a more environmentally friendly technology used in steel making, are less common in China.

A global rebalancing of energy-intensive manufacturing would cost jobs in China. However, China has already been actively moving some of its production capacity overseas, largely to developing countries involved in the Belt and Road Initiative (BRI).

In the steel industry, a number of state-owned steel conglomerates have built or acquired overseas facilities, including HBIS Group’s purchase of the largest steel mill in Serbia; Shougang Steel’s investment in a new plant in Malaysia; Wuhan Steel’s new plant in Liberia; and Nanjing Iron and Steel’s joint venture with a local partner in Indonesia. A private Chinese steel company, Delong, has also recently invested in Thailand.

Although such investment to BRI countries aligns with the signature foreign policy of Chinese president, Xi Jinping, it is economically risky because of weak institutional infrastructure, heavy debt burdens, and high levels of political instability in many of these countries. By contrast, the quality institutional environment in developed countries is likely to provide better protection for investors.

A global industrial rebalance in the making

From a US perspective, any increase in domestic production of energy-intensive goods such as steel would be a political victory for Trump, who campaigned in part on a promise to restore US manufacturing pre-eminence. The US steel industry currently employsabout 269,000 workers, accounting for less than 0.2% of the US work force. However, steel production is largely concentrated in several Rust Belt states, which played key roles in electing Trump.

An industrial rebalance that turns exports of energy-intensive goods from China into direct investment in those industries in the US would seem to serve the interests of both sides.

The first attempt by a Chinese steel company, the Angang Group, to invest in the US faced opposition in 2010 from members of the powerful Congressional Steel Caucus. However, the Committee on Foreign Investment, the authority responsible to review and approve such foreign investments, did not launch an investigation as called for by the lawmakers, and the investment was free to proceed. The plan was subsequently withdrawn for internal reasons within the company.

Meanwhile, with incentives and support from the local government of Texas, another Chinese steel company, Tianjin Pipe Corporation, has been manufacturing seamless steel pipes in the US since 2014. When fully built, this US$1-billion facility will be the largest single manufacturing investment in the US by a Chinese firm. Other significant investments from China to the US in energy-intensive industries include the US$1.85 billion-project of YCI Methanol One by Shandong Yuhuang Chemical and the US$100 million-project of Golden Dragon in Alabama to produce advanced copper tubing.

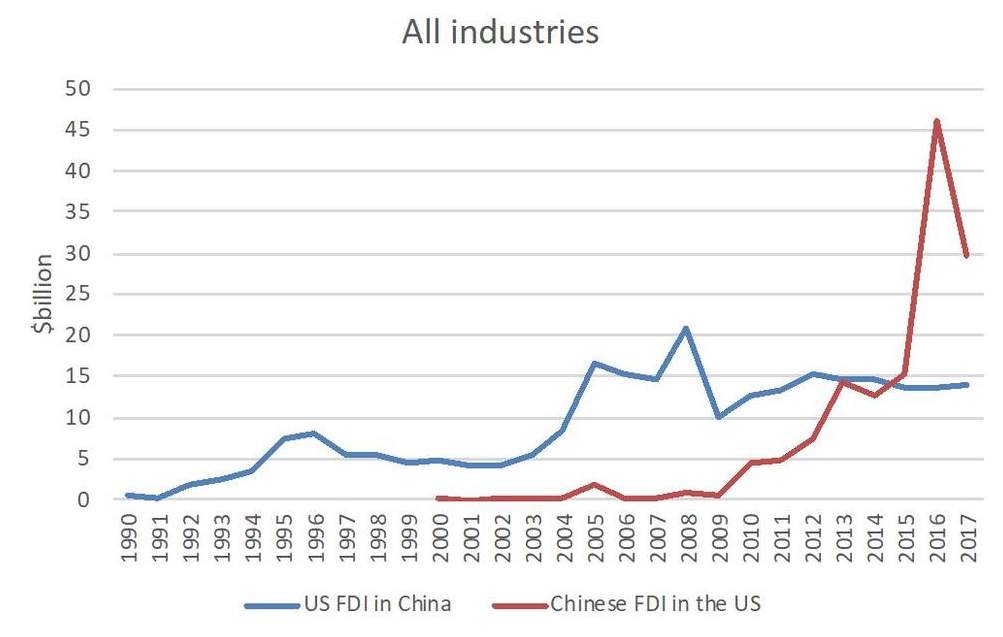

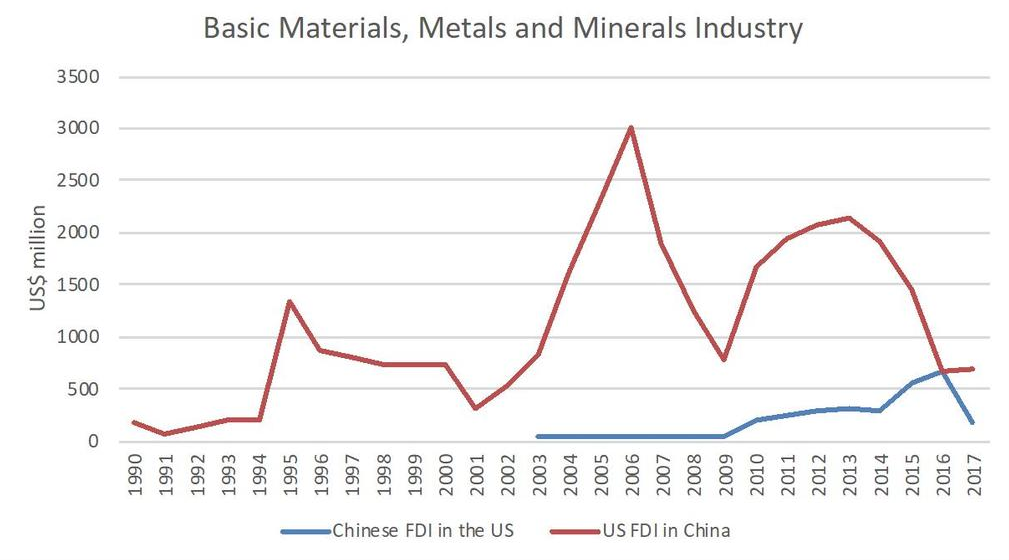

Since 2015, China has invested more in the US than the other way round

During the past several decades, production in a number of energy-intensive industries, such as steel, aluminium, and glass, has moved from developed countries to China. But a reversal seems to be taking place.

Since 2015, China has invested more in the US than the other way round; and in 2016 for the first time the scale of the foreign direct investment (FDI) flow from China to the US surpassed that from the US to China in the basic materials, metals and minerals industries. Chinese investments in those industries in the US have been motivated by cheap land, plant and energy, as well as reflecting a strategic move by Chinese companies to overcome barriers to trade such as tariffs and anti-dumping investigations into Chinese exports.

Bilateral FDI flows between the US and China: 1990-2016

Source: The Asia-Pacific Journal

Source: The Asia-Pacific JournalThe bilateral FDI flows between the US and China in basic materials, metal and mineral industry: 1990-2016

Source: The Asia-Pacific Journal

Source: The Asia-Pacific JournalThe global industrial rebalance is economically viable, and can be more politically effective and environmentally beneficial if supported by appropriate policies in China and the US. This could involve measures discouraging steel production and exports on the Chinese side, and encouragement of Chinese investment in steel plants in the US; measures that would be more effective than the current punitive tariff imposed by the United States that threaten to lead to economic warfare between the two countries.

For example, China could remove incentives for exports of energy and environment-intensive products, such as value-added tax (VAT) rebates, which refund producers part of the VAT they pay when making export sales. China could even re-instate its export tariff on energy-intensive products, such as steel, which it introduced in the middle of the previous decade amid concerns about the environment and the country’s resource security.

However, since the financial crisis of 2007–08 the export tariff has been largely scaled back to help the steel industry weather difficult economic conditions. By taking measures to restrict its exports of products such as steel and aluminium, China could simultaneously free itself from accusations of dumping and reduce excess production and environmental degradation while improving relations with its major trading partners including the US. On the American side, the Trump administration could make clear that Chinese investment in such areas as steel is unlikely to cause national security problems and is welcome.

Given the imbalance accumulated over past decades, a global industrial rebalance in energy-intensive manufacturing will take many years, if not decades, to achieve. But if successful, it would reduce the environmental costs of producing energy-intensive goods, and thus benefit the world.

This is an abridged version of an article published by the Asia-Pacific Journal here, which itself was based on an article that first appeared in Foreign Affairs, available here.

Now more than ever…

chinadialogue is at the heart of the battle for truth on climate change and its challenges at this critical time.

Our readers are valued by us and now, for the first time, we are asking for your support to help maintain the rigorous, honest reporting and analysis on climate change that you value in a 'post-truth' era.

Đăng nhận xét