For a few months earlier this year, it seemed like there was no stopping the wave of renewable energy projects coming online in Vietnam.

In March, the Srepok 1-Quang Minh solar power plant, Vietnam's largest at the time, opened in Dak Lak Province. In September, it was surpassed by the Dau Tieng Solar Power Complex in Tay Ninh Province, which is Southeast Asia's largest solar farm. The following month, the Asia Development Bank agreed to help fund the country's first floating solar power facility on a reservoir in Binh Thuan Province. If built, it will be the region's largest such facility. And in October, Vietnam Electricity (EVN) announced that 12,765 rooftop solar systems are selling power to the grid nationwide.

Wind power is expected to grow dramatically as well, with installed capacity forecast to more than triple by 2021, launching Vietnam toward the top of Southeast Asia in this sector. These projects were far from the only ones to come online recently. In the second quarter of this year, 81 new solar facilities were added to Vietnam's power grid, compared to just five in the first quarter of 2019.

The Dau Tieng Solar Power Complex in Tay Ninh. Photo via VnExpress/Quynh Tran.

This growth in renewable power generation is vital, as in July, the Ministry of Industry and Trade (MOIT) admitted that the country is likely to face severe power shortages starting in 2021. Power generation capacity will need to increase from the current 48.6 gigawatts (GW) to 60 GW in 2020 and 130 GW by 2030. This is due to rapidly rising electricity demand as Vietnam continues its impressive economic growth, and delays on major thermal- and gas-fired power stations. Such an expansion of capacity is expected to cost nearly US$7 billion a year.

The explosion of solar projects in particular was spurred by a feed-in tariff (FiT) introduced by the Vietnamese government in 2017. A FiT is the rate paid by a power utility, in this case the government-owned Vietnam Electricity (EVN), to the company which operates a solar plant. The 9.35 US cents per kilowatt hour (kWh) tariff established by MOIT was very generous, and developers flooded in. A wind energy FiT was initiated in September 2018 as well, though growth hasn't been quite as robust as solar.

Too much of a good thing?

The sheer numbers behind this solar surge are incredible, and Vietnam has become the darling of investment in the region, easily eclipsing its neighbors. The 86 new projects completed in the first half of this year added 4.5 gigawatts (GW) of capacity to the national grid, equaling about 10% of Vietnam's total power capacity. EVN reportedly set up special teams working three shifts a day just to connect new plants.

The government had aimed to have 850 megawatts (MW) of solar online by 2020, while the 4.5 GW installed thus far has already reached their 2025 goal.

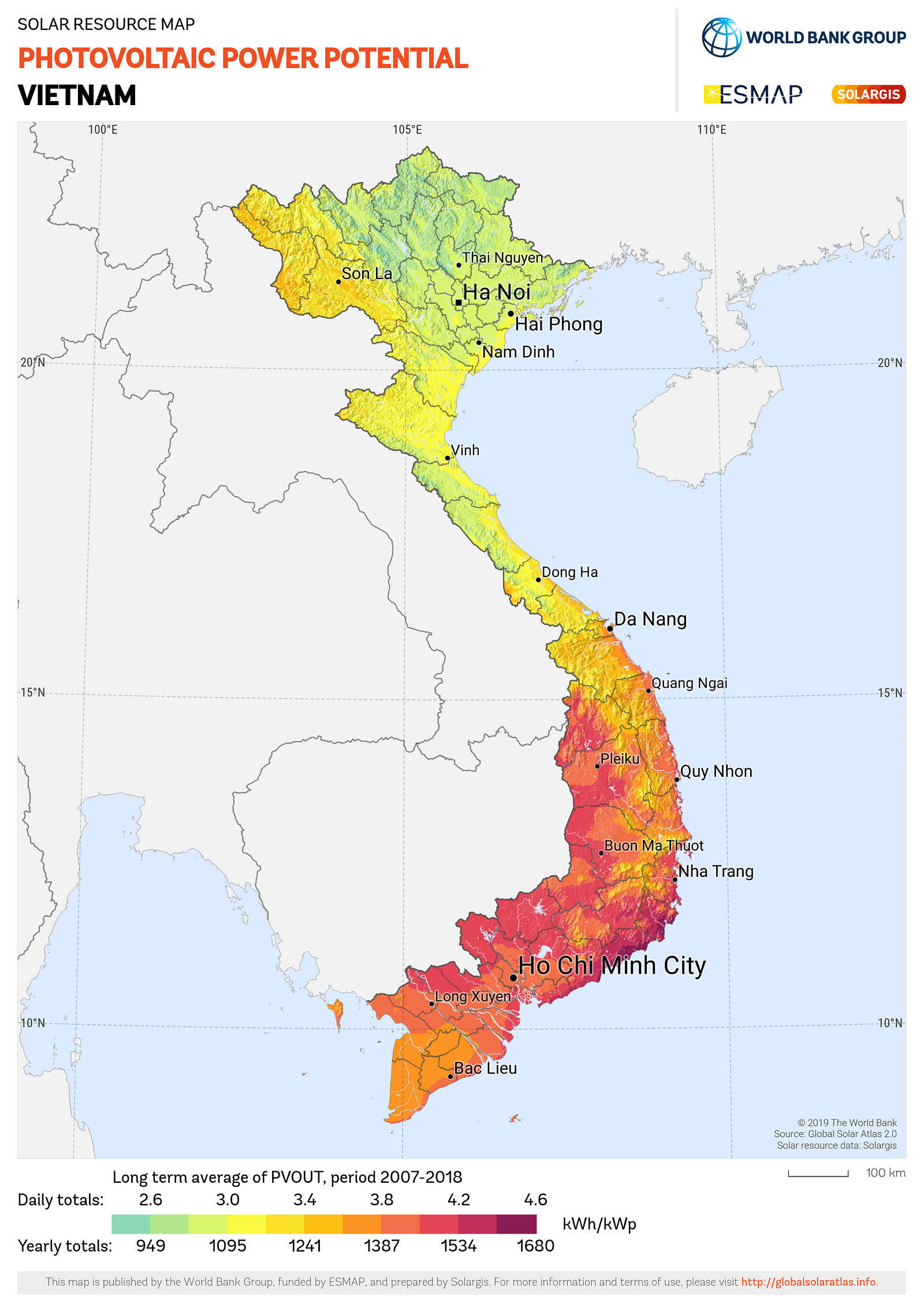

However, Vietnam's power grid isn't currently capable of handling such concentrated power. According to Adam Ward, Vietnam representative for the Global Green Growth Initiative (GGGI), nearly half of those 4.5 GW have been installed in just two provinces: Ninh Thuan and Binh Thuan, on the sun-baked south-central coast.

"There are 63 provinces in Vietnam so it's not great that two of them have almost 50% of the solar generating capacity because the grid there isn't strong enough to receive all the power they're producing," Ward told Saigoneer.

Sunny, windy Binh Thuan is ideal for renewable energy development. Photo by Michael Tatarski.

At one point in June, Ninh Thuan's high-voltage central power line was reportedly operating at up to 360% over its safe capacity.

The FiT which ushered in this year's solar bonanza expired in June, and a new one was expected to be introduced shortly thereafter, but that has yet to take place. As a result, new projects are frozen, as developers can only move forward with a clear pricing system in place.

GGGI, according to Ward, is advocating for a three-zone tariff scheme, as opposed to the blanket nationwide FiT of 2017.

"For example, you would have a higher tariff in the north, less in the center and less again in the south," he said. "I look at irradiation maps of Vietnam which show potential solar power and the north is always a cooler color, but the amount that the north of Vietnam gets is more than, say, southeast England, and certainly a lot more than Germany, so solar still makes sense there. But if you have one national tariff, you're going to go where you get the most bang for your buck, which is in the south."

However, the government is currently considering an auction system, in which selected sites would be auctioned off to the developer with the lowest bid.

"This would be good, because you can look at your grid capacity and say there's space capacity in, say, Quang Ninh, so we can accept 250 MW there and here are the sites and ask for bids," Ward explained. "But what you need is a very clear and transparent process with a very good, strong power purchase agreement with EVN. There are challenges with the current one, for example if EVN can't accept power in Binh Thuan for a given amount of time because the grid can't handle it, they won't pay for it, so the solar developers are left with power they can't sell."

Dung Nguyen Anh, a project officer at the German development agency GIZ focusing on solar and biomass power in Vietnam, doesn't believe an auction system will happen anytime soon. "We don't have a policy for that, so maybe you could do one or two pilot projects, but if you do auctioning as a general mechanism, Vietnam needs to change some regulations, which takes two-three years for implementation," he said.

Both GGGI and GIZ are pushing for a new FiT because without a price incentive, developers won't invest.

Ward is also careful to note that there is not too much solar coming online, as some media coverage has implied. Vietnam's overall power grid is capable of handling more power, but it has to be distributed evenly instead of concentrating in one or two provinces.

"Given the percentages that Vietnam is trying to integrate into the grid it's not a problem at all, and we see countries like Denmark which have much higher renewable energy, and in Vietnam with the grid the way it is, it can handle these percentages, but at the moment 50% is in two provinces which don't have much demand."

The coal factor

On the opposite end of the sustainability spectrum are thermal power plants, which Vietnam is heavily reliant on. Thermal power accounts for roughly 40% of the country's generating capacity, and that figure is expected to rise over the next decade.

Last week, Prime Minister Nguyen Xuan Phuc ordered EVN to do whatever it takes to prevent power shortages in 2021 and beyond, specifically naming six large thermal power plants that need to be completed.

However, according to Ward, international financing for coal-fired projects is drying up, particularly among western institutions, as countries reckon with the negative impacts such facilities have on air quality and climate change. Chinese funding for such developments is still available though.

One of the reasons for the continued focus on coal in Vietnam is that it is included in the current national power development plan, which was released in 2016, parts of which are now outdated.

"The speed at which renewable energy prices have come down, particularly in solar and wind, is dramatic," Ward said. "In the power development plan, if you look at the pure cost of coal while ignoring the externalities in terms of the air quality effect, etc., then back when they did the revised power plan #7, yes solar solar and wind were more expensive; however the landscape has changed dramatically."

Ward believes the development plan needs to be revised to account for this change, though the reality is that thermal power can't be completely removed.

"The government does need some base load of thermal power," he shared. "I can't say to you, 'no fossil fuels and Vietnam will be fine,' that's living in a dream world. But, Vietnam doesn't need to build any more coal. They could focus on gas, which they have domestic resources of, and they could focus on energy efficiency, where there are huge gains to be made."

Moving forward

This is what Nguy Thi Khanh, founder of the Hanoi-based Green Innovation and Development Center (GreenID) and a Goldman Environmental Prize winner, advocates as well: "The new power plan #8 should cancel the expansion of all new imported coal-fired power projects, and instead increase the share of renewable energy as much as possible, together with grid improvement."

Upgrades to the grid are also part of PM Phuc's order to EVN, so progress will be made on that front.

Other developments are less promising. In August, Reuters reported that Vinacomin, a state-run coal producer, met with a coal company based in the US state of Pennsylvania to discuss importing American coal to supply thermal plants here. The country also plans to start importing liquefied natural gas (LNG) for under-construction gas-fired power plants, which are less environmentally damaging than thermal plans, but not as clean as solar or wind.

Such news, particularly related to coal, concerns Khanh. "I think that due to financial challenges and local opposition, coal power projects are not easy to develop in the coming years in Vietnam," she said. "But if they are built anyway, they will continue to pollute our soil, water and air, which are the benefits offered by renewable energy."

New attention is also being paid to coal due to the recent dangerous air quality in Hanoi, though EVN has rejected any connection between the two. Ward, however, disagrees.

"There's a clear correlation between coal power and air quality challenges," he said. "Look at Vietnam, look at China, what they've been through and kind of come out the other side, look at South Korea, which has taken a real step this winter to shut a lot of coal-fired power stations to help with their air quality challenges."

It appears some officials at the provincial level have recognized this. Last week, the leadership of Thua Thien-Hue confirmed that thermal power is no longer included in its industrial development plans.

Meanwhile, the full potential of the range of renewable possibilities has yet to be explored in Vietnam. Floating solar power plants built on the surface of a reservoir, for example, are in their infancy.

"They are very promising," Ward explained. "There's obviously challenges with land in Vietnam, so using reservoirs is fantastic. You circumnavigate any land rights issues, and of course if you're using a reservoir that's part of a hydroelectric dam, then your grid connection is very close."

Vietnam currently has 306 hydropower plants in operation, meaning there are hundreds of reservoirs holding potential for floating solar. Such facilities, either floating or ground-based, can also be built quickly, going from groundbreaking to completion much faster than a thermal power plant.

Rooftop solar holds great promise as well, particularly in the industrial sector, where countless new factories are coming online as Vietnam reaps the benefits of continued robust economic growth and production shifts amid the China-US trade war.

GGGI is also working in this area. "We're looking at industrial parks and designing a financing facility that will sit within a Vietnamese bank and blend cheaper international sources of climate financing with domestic capital to buy the loads and investment for developers to roll out rooftop solar," Ward said. "Vietnam has a huge textiles industry and a huge electronics industry, so all these factories that are power hungry and run throughout the day are great for rooftop solar. We just haven't seen a finance structure that really supports it."

Dung, from GIZ, believes the outlook for renewable energy in the next few years is murky given the lack of clear politics, particularly since a new solar FiT hasn't been announced.

"For the long-term, renewable energy will be key, but for the next five years, it's difficult to say because it depends on whether the government will promote renewable energy, including wind and biomass, or develop it more slowly," he shared. "The grid cannot develop fast, so short-term capacity is very low, and they need time to upgrade the power grid."

Ward, for his part, is more optimistic. "All the solutions are there, and certainly in the last two-three years we have seen a step change in the attitude and commitment of the government toward renewable energy," he explained. "I think as well it's been brought to the fore because they really need the power and fast. It's moving in the right direction, but of course it needs to be quicker."

Đăng nhận xét