April 18, 2021

Until Jan 9, 2014, the Playa de Anzoras, a 2,200-ton tuna fishing vessel named for a beach in Spain, built in Spain and owned by Spaniards, sailed under the Spanish flag.

On Jan. 10, it dropped the Spanish flag in favor of that of Seychelles, a small archipelagic nation in the Indian Ocean.

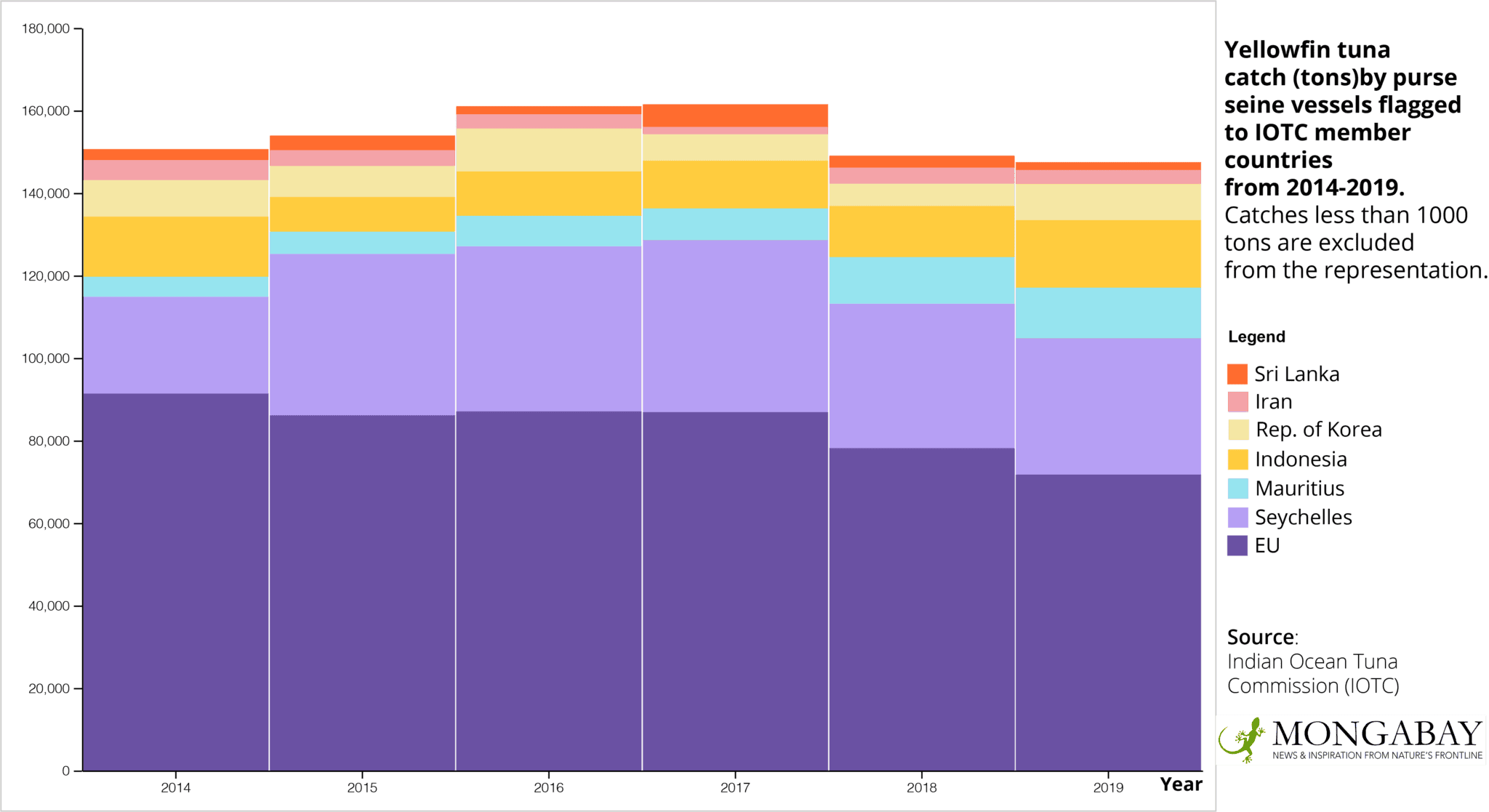

Neither Spain nor continental Europe share a coast with the Indian Ocean, where Playa de Anzoras operates. Yet the European Union dominates tuna fisheries here and profits the most from it.

This dominance is, in part, explained by ships like the Playa de Anzoras, which is flagged to Seychelles but ultimately controlled by European companies, according to records reviewed by Mongabay.

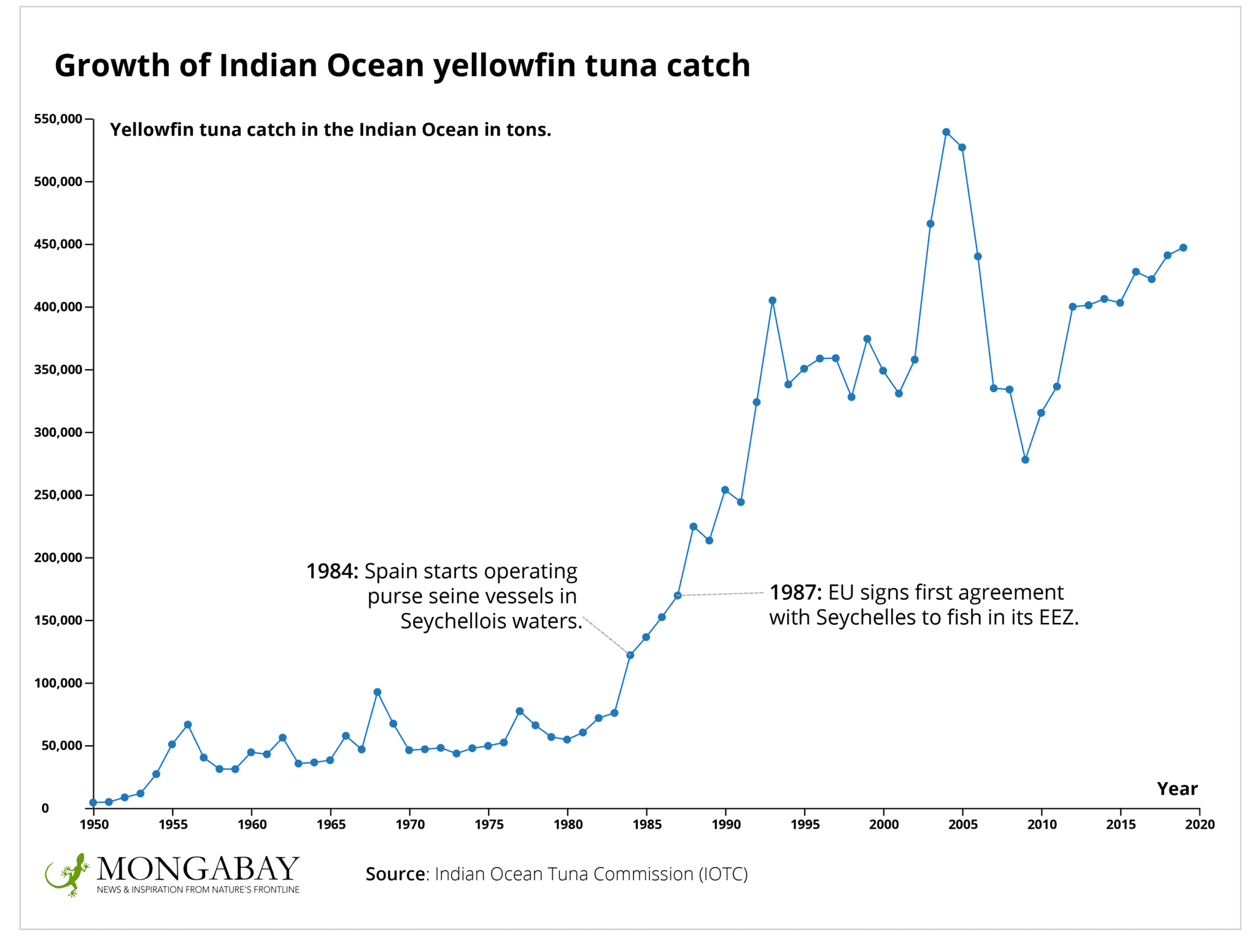

EU-controlled ships have pulled in the lion’s share of the region’s valuable yellowfin tuna (Thunnus albacares) for more than three decades. Now, the stock is teetering on the verge of collapse. A plan to stop overfishing and restore it has failed.

This March, talks on the issue ended in a stalemate. The EU wants other members of the Indian Ocean Tuna Commission (IOTC), the intergovernmental agency charged with managing tuna fisheries in the region, to be subject to greater restrictions, while some observers point to the EU’s own failure to play by the rules and save a stock that it profits so greatly from.

The Indian Ocean is ringed by developing countries, many of which have only in the last century gained independence from European colonial rule. Some see EU states’ grip over resources like tuna as the persistence of an exploitative relationship.

“The attitude of the EU is hypocritical and neo-colonial,” Nirmal Shah, chief executive of the nonprofit Nature Seychelles and former head of the Seychelles Fishing Authority (SFA), told Mongabay. “You have some of the richest countries in the world overfishing and they are blaming poorer countries.”

Leaving ‘trinkets’ for a ‘treasure’

Tuna fisheries are lucrative, feeding a market worth billions of dollars. The Indian Ocean is the second most productive tuna fishery in the world, and most of this tuna is caught in the western Indian Ocean.

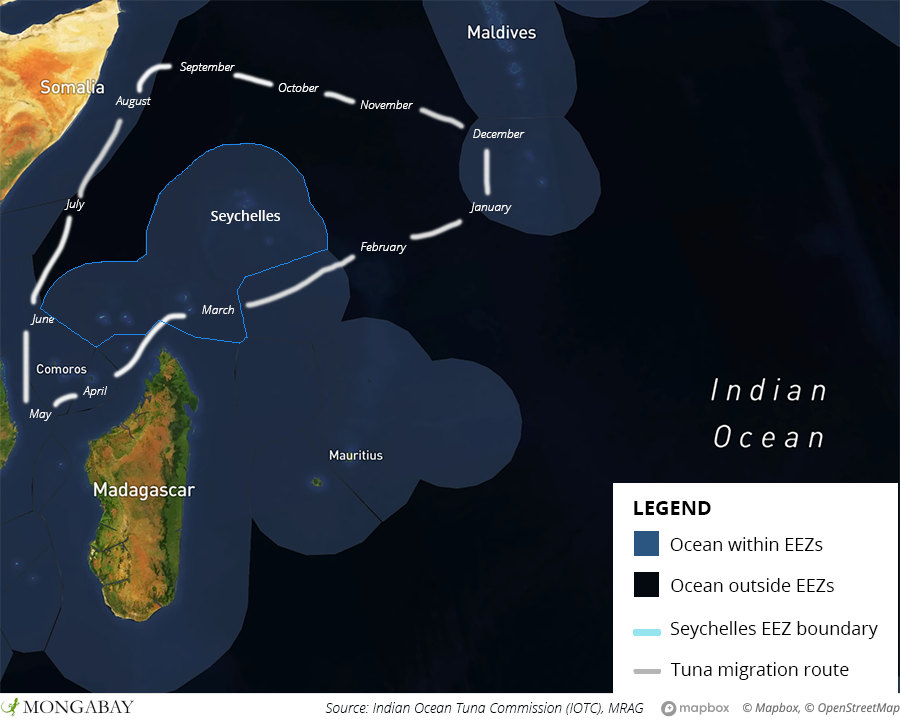

In 1982, the U.N. recognized states’ sovereign rights to marine areas 200 nautical miles (370 kilometers) from their coasts, creating exclusive economic zones (EEZs). Seychelles, a fledgling nation that won independence from the U.K. in 1976, stood to benefit immensely. Between them, the 100 or so islands scattered just south of the equator in the western Indian Ocean carve out an EEZ of 1.37 million square kilometers (530,000 square miles), three times the size of California.

Seychellois waters are a prime spot for tuna fishing, with yellowfin, bigeye (Thunnus obesus) and skipjack (Katsuwonus pelamis) being the major catches there.

As tuna fisheries’ profitability in the Atlantic Ocean declined, European nations like Spain and France sought new fishing grounds. The formation of EEZs forced these countries to enter into agreements with poorer coastal states to feed the continent’s growing appetite for seafood. (The EU is second only to China in seafood consumption.)

“We have this amazing orchard of apple trees, and right now we do not have ladders to climb to them and collect the apples,” is how Jeremy Raguain, who works for the Seychelles Island Foundation, described it. “E.U. and other countries, which have very advanced technology and ships, say: ‘look, we have the ladders to take these apples that you would not otherwise be able to get.’”

In the western Indian Ocean, the European Economic Community (EEC), the precursor to the EU, struck deals with Madagascar and small island nations like Seychelles, Mauritius and Comoros, which didn’t have the financing or technical capacity to harvest their own marine resources at a commercial scale, partly due to decades of colonization.

Spain signed a pact with Seychelles in 1983 allowing its ships to fish migratory species like tuna in Seychellois waters, and the first Spanish purse seiners started operating there in 1984. But with its entry into the EEC in 1986, Spain’s fishing activities, like those of France, became subject to agreements between the EEC and Seychelles.

These agreements have long been criticized as disadvantaging the smaller, poorer countries.

There are direct benefits for states like Seychelles. Fishing access fees are an important source of revenue for the country. Under the latest agreement with the EU, this amounts to 5.3 million euros ($6.3 million) annually.

EU ship owners also pay about 80-85 euros ($97-$102) per ton of tuna. You can buy canned yellowfin for about $17 per kilogram on Amazon. A ton of tuna — 1,000 kilograms — would cost $17,000 at that price.

“Yes, they bring in some money, yes they give us license fees. But look at what they give us compared to the profits that these people make,” Shah said. “They give us trinkets for our treasure.”

Canned or pouched yellowfin tuna caught by purse seine vessels in the Indian Ocean brings in $1 billion every year from customers, according to an analysis by The Pew Charitable Trusts, a U.S.-based policy research group. Almost 80% of this tuna is caught by European-controlled vessels.

These vessels are mostly purse seiners, some of the world’s largest industrial fishing boats. They deploy seine nets, up to 2 km (1.2 mi) in length if laid out flat, which encircle the fish school and squeeze shut at the bottom like a drawstring purse.

A net spread across oceans

There are 15 Spanish-flagged and 12 French-flagged purse seine vessels currently authorized to fish in the Indian Ocean.

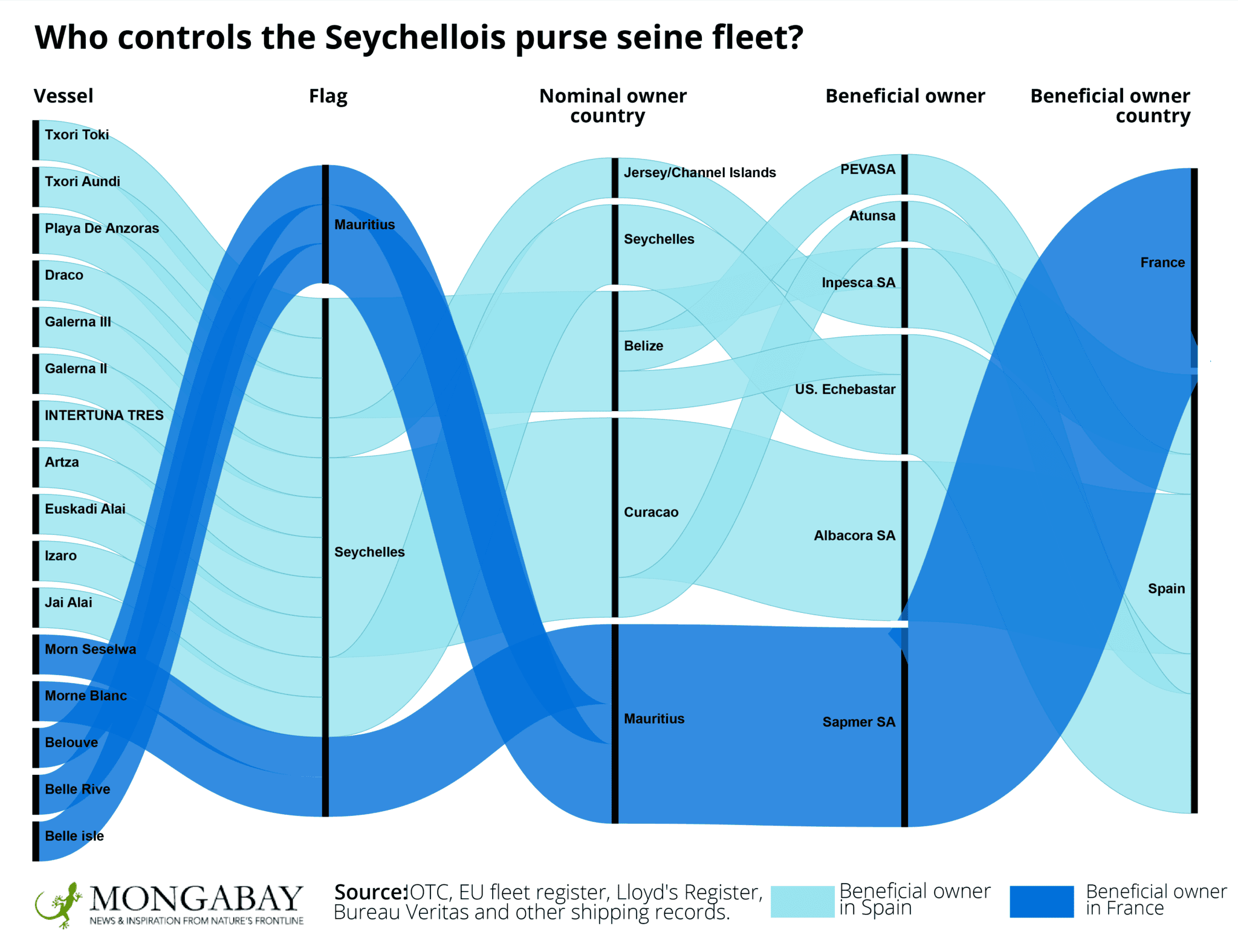

On paper, Seychelles has a purse seine fleet operating in the Indian Ocean that rivals that of Spain, the EU’s biggest fishing nation. But the entire fleet of 13 vessels that fly Seychelles’ flag is effectively in European hands.

EU records and other fishing agreements reveal that Pesquería Vasco Montañesa SA (Pevasa), a founding member of Spain’s Pevaeche Group, owns Playa de Anzoras. Albacora SA owns four other Seychelles-flagged vessels, S. Echebastar owns three, Inpesca owns two, and Atunsa, one. All these companies are based in Spain’s Basque Country, a traditional stronghold for the fisheries industry in Europe.

French company SAPMER SA, controls the remaining two vessels in the Seychellois fleet. It also owns three boats that make up the entire purse seine fleet of Mauritius, another small island-nation in the western Indian Ocean.

The Albacora group, which has four vessels in the Seychellois fleet and annual revenues exceeding $100 million, is a major player in tuna fisheries. It owns vessels, canneries and tuna marketing companies. From its start as a family-run outfit in the early 1970s in Spain, it now operates in the Atlantic and Pacific oceans, in addition to the Indian Ocean where it has vessels flagged to both the EU and Seychelles.

Using a flag of convenience is a widespread but controversial practice. It allows vessel owners to save on taxes, bypass labor regulations, and avoid tougher oversight and increasingly stringent environmental checks that their own countries may require.

For the first time, the EU–Seychelles agreement signed last year set aside about 175,000 euros ($209,000) a year to be paid by EU purse seine vessel owners toward an environmental fund. It also seeks to phase out the use of harmful fish aggregating devices, or FADs, fishing aids that have contributed to overexploitation of yellowfin populations. But provisions under the agreement don’t extend to the Playa de Anzoras or the 12 other Seychelles-flagged ships, even if their beneficial owners, the ones that ultimately profit from the ships, are European.

While EU records list Spanish company Pevasa as the owner of the Playa de Anzoras, IOTC records identify the ship’s owner as Sea Breeze Ventures Limited, based in the Caribbean nation of Belize. This company, per the D&B Business Directory, has one employee. While the connection between Pevasa and Sea Breeze remains unclear, it bears the hallmarks of a common arrangement in the fisheries industry in which a larger established company, the beneficial owner, sets up one or more companies in a tax haven as nominal owners of its fleet or a portion thereof for business purposes.

All the Spanish-backed Seychellois vessels appear to have nominal owners headquartered in jurisdictions like Belize that regularly feature in the EU’s list of tax havens. Neither Pevasa nor the other European companies that own Seychelles-flagged purse seiners responded to attempts by Mongabay to seek a comment for this story.

A ship’s flag determines which country is responsible for the vessel, and in the case of yellowfin tuna, which country’s quota its owners can exploit. By sailing under the flag of a small island nation with a nominal owner based in a fiscal paradise, a ship can maximize profits and minimize regulatory oversight.

“The use of flags of convenience is a loophole,” said Vanya Vulperhorst, a campaign director at the European office of the NGO Oceana, headquartered in Washington, D.C. “It’s a way to circumvent EU requirements.”

“It is really an oversight if you are trying to get more sustainable fisheries,” she added.

Yellowfin tuna in the red

Indian Ocean yellowfin tuna is not only one of the world’s most profitable fisheries; it is also one of the most threatened.

The stock could collapse as soon as 2026, according to an assessment the IOTC commissioned. The tuna management agency has 31 members, including local parties like Seychelles, and others like the EU, China and Japan that operate distant-water fishing fleets in the region.

In 2016, the agency launched a yellowfin rebuilding plan, which required member states to reduce their purse seine catches by 15% from their 2014 levels. An IOTC report from 2021 found that EU-flagged purse seiners overfished yellowfin tuna in 2017 and 2018, after the rebuilding plan was implemented.

“Everybody has an equal responsibility to abide by their quotas,” said Glen Holmes, a fisheries expert with The Pew Charitable Trusts. “But the EU as a well-resourced country block has a moral obligation to set the highest standard.”

The Seychelles-flagged purse seine fleet also exceeded its yellowfin quota in 2017 and 2018. Being a small island developing state, a special status under the U.N., Seychelles was allowed to choose the baseline year upon which to calculate its target quota. Instead of 2014, when its catch was only 23,463 tons, it chose 2015, when its catch stood at 39,072 tons. This resulted in a much higher target quota under the rebuilding plan — another advantage for European-owned vessels flying the Seychellois flag.

Mauritius is also recognized as a small island developing state and chose 2018 as its baseline year, when its catch was 11,322 tons, as opposed to 2014, when its fleet caught only 4,844 tons of yellowfin tuna. As a result, its purse seine fleet is today allowed to catch about 10,500 tons of tuna, more than double what it was catching in 2014.

Christopher O’Brien, the IOTC’s executive secretary, told Mongabay there were no penalties for countries overshooting their quota.

Experts argue that even the present catch reductions are not enough to save the stock.

“The yellowfin tuna stock rebuilding plan put in place by the IOTC in 2016 has, thus far, failed to reduce catches from the baseline at all, let alone by the 25 percent necessary to save the stock from collapse,” a 2020 Blue Marine Foundation report authored by Jess Rattle concluded.

The rebuilding plan’s failure has prompted the IOTC to hold a series of special meetings to build consensus around measures to curb overfishing. At a meeting held this March, the EU proposed that catch reductions for purse seiners increase marginally from 15% to 18%. The Maldives, another small island nation, is pushing for more: a 35% cut for purse seiners from developed countries and 28% from developing countries.

“The European Union proposal is less ambitious,” Holmes said. “There is less change involved in the EU’s proposal than there is in the Maldives’ one. The Maldives’ proposal will almost certainly reduce the overall catch to a level that will reduce or prevent overfishing.”

Julio Morón Ayala, managing director of OPAGAC, which represents the Spanish tuna fishing industry, including Albacora, told Mongabay in an emailed response that his organization wants fleets of IOTC member countries that are currently exempt from reductions to also be subject to catch cuts.

“Since 2016, IOTC regulation has established a larger cut on the purse seine gear (15%) compared to others (10-5%) and exempting most of the Coastal countries,” Ayala said. “So, the EU has and is taking a major cut on the yellowfin catch, but the final result is that others gears had increased their catch offsetting the reduction achieved.”

The countries currently exempt from cuts are almost all developing Indian Ocean countries, including Yemen and Madagascar, some of the world’s poorest nations. Most do not operate industrial fleets but rather small-scale fisheries in their own EEZs that largely supply local populations. None of the individual countries’ shares of the yellowfin tuna catch is anywhere close to the EU’s. But the combined share of this dozen or so countries has grown in the past few years.

Experts say that in the absence of proper enforcement, illegal fishing activity will also deplete fish stocks in the region.

Regulatory gray zones

Even if the quotas are reduced, enforcing them will still be difficult.

The IOTC relies on self-reporting by member states to track catches, so transgressions are hard to pinpoint independently. In 2018, a discrepancy in Spain’s catch reports came to light only after Blue Marine Foundation flagged it. The IOTC later confirmed that Spain underreported its yellowfin tuna catch by 30% that year.

The ability of Seychelles, a small coastal state whose total government revenues stand at around $400 million, to police multimillion-dollar companies with beneficial owners abroad is questionable, as suggested by the Seychellois fleet’s involvement in overfishing yellowfin. An IOTC report found poor training and a lack of support for the country’s observer program, where personnel board ships to collect data and monitor their practices. The program is partly funded by the industry.

“Operators can choose freely where to register their vessels,” the EU’s Office for Seychelles and Mauritius said in a statement in response to Mongabay’s questions about ships using flags of convenience. The office becomes concerned only if vessels change flags regularly to “escape obligations or circumvent their quota.” Since many of the vessels have flown the Seychelles flag for several years, it doesn’t qualify as abusive, the statement said.

“Seychelles has to exercise its flag state responsibilities on their fleets and report on their compliance records to the RFMOs [regional fisheries management organizations] covering their EEZ,” it added.

The Seychelles Fishing Authority and the ministry of fisheries did not respond to several attempts by Mongabay to seek comment.

The ship owners view the arrangements as investments and point to the benefits they offer to coastal states. “Since our operations started back in the 60’s, some companies not only invest in coastal countries through fleet, but through tuna processing plants inland.” Ayala from OPAGAC said in his email. “In the Indian Ocean, the EU fleet operating since 1987, has developed the tuna industry in Seychelles, Mauritius, Madagascar and Kenya, where more than 15,000 direct employments depend on the tuna operations.”

However, foreign workers are overrepresented in this sector. Of the roughly 2,000 employees at Indian Ocean Tuna Ltd. (IOT), the largest cannery in Seychelles, for instance, almost 70% are foreigners.

The Thai Union group that owns the cannery supplies some of Europe’s leading seafood brands, including John West, Petit Navire, Parmentier and Mareblu.

Fishing overseas, under the radar

It isn’t just the ownership of the Seychellois purse seine vessels that is shadowy; they often operate under the radar. A recent analysis showed that, in violation of international law, most of the Spanish-controlled tuna purse seine vessels did not continuously transmit their locations via the automatic identification system (AIS).

AIS, which tracks vessels through their unique alphanumeric signature, allows seafarers to map out other ships’ locations and aids navigation. But it is also central to coastal states’ ability to monitor vessels’ activity to ensure they are not entering protected areas or fishing where they are not supposed to.

The analysis, by the U.K.-based NGO OceanMind compiled by Blue Marine Foundation, looked at AIS use by tuna purse seiners over 850 days between 2017 and 2019 in the western Indian Ocean. It revealed low rates of AIS transmission for both Spanish-flagged and Seychelles-flagged ships.

The Playa De Anzoras transmitted its location for less than 40% of the 850-day period. It did better than most. The Artza, owned by Atunsa, did not transmit its location at all. For the nine remaining Spanish-controlled ships, the figure ranged between 3% and 33%. The numbers were similar for the 14 Spain-flagged ships considered in the report.

Subsidizing unsustainable fishing

The fact that these ships’ beneficial owners are based in Europe also allows them to profit from EU fishing subsidies. Between 2000 and 2010, Spain’s global fishing industry received more than $8 billion in subsidies. The Albacora group has benefited from subsidies not just from the EU but also from the Spanish government.

Critics say such state subsidies allow unprofitable fishing to remain viable and lead to overfishing.

The EU has continued to subsidize fisheries over the years, while trying to purge those that lead to overexploitation. Reports that the EU is seeking to reintroduce allegedly harmful fishing subsidies as part of the European Maritime and Fisheries Fund have sparked alarm.

“Between 2021 and 2027, around seven billion euros of public money will be injected into the ocean economy. However, countless studies and reports show that the vast majority of the fund is used to encourage overfishing and fuel the demise of nature at sea,” a group of more than 100 scientists wrote in an open letter published in November 2020.

It has also raised concerns in Seychelles, whose fisheries sector is greatly impacted by the EU’s actions. “For us in the Western Indian Ocean where 40 percent of the E.U. catch of tuna comes from, this may mean the end of our tuna stocks,” Shah told local news agencies.

He told Mongabay in an interview in March that the EU’s reputation was being “sullied” because of the actions of two countries: Spain and France. “It is not even two countries but the private companies in two countries of the EU being supported, defended and paid for by the EU,” he said.

Tuna and profits flow out

European interests dominate Indian Ocean tuna fisheries not just in terms of supply but also demand.

Almost all of the processed tuna from Seychelles, Mauritius and Madagascar is exported, and the exports are largely destined for the EU. Canneries in those countries are all supplied by the European industrial purse seine fleet. The mainly European shipowners are assured a “captive market” for their catches, a 2017 report from the EU think tank IDDRI found.

These tuna exports have duty-free access to European markets under economic partnership agreements, saving them from a 24% tariff. “Under the rules of origin that are part of the agreements, the canneries in Seychelles, Mauritius and Madagascar can use only fish caught either by their fleets or by the EU fleets,” Liam Campling, an expert on global trade centered on tuna fisheries, at the Queen Mary University of London, said. “The rules of origin have been a massive support to the EU distant water fleet because it means they have a locked-in market.”

Since almost all the tuna comes from EU-controlled ships, it is unclear how the three countries benefit from these tax breaks.

“If the Europeans really wanted to deal with the problem of yellowfin, they can,” Campling said. “but they don’t want to take the economic hit.”

In some ways, the biggest cannery in Seychelles, Indian Ocean Tuna Ltd. (IOT), embodies the unequal relationship around tuna that has become entrenched between some Indian Ocean countries and the EU. It is owned by Thai Union/M.W. Brands, a Thailand-based leading supplier of canned tuna. It buys tuna almost exclusively from EU-owned ships, sends most of its tuna back to the EU duty-free, and employs mostly foreigners.

Tuna and the money to be made from it leave Seychelles every year and it’s not clear if the country’s gains outweigh its losses. What is certain is that those gains are themselves in jeopardy.

“If the worst were to happen and fish stocks decline to a point where we couldn’t fish anymore, the EU purse seine fleet could almost certainly go to a different ocean to fish,” says Rattle of the Blue Marine Foundation, “whereas the coastal states left behind, they can’t go anywhere else, so they will just be stuck with no fish.”

For Shah, too, it isn’t just immediate economic gains that are at stake. “Is it right for you, no matter how much money you make, to destroy our natural resources?” he asked. “What will happen to future opportunities for Seychellois?”

This is the first story in a two-part series about the effect European tuna fishing has on the economy and marine environment of Seychelles, an archipelagic nation in the Indian Ocean.

This article by Malavika Vyawahare was first published on Mongabay.com on 8 April 2021. Lead Image: Tuna fisheries in Seychellois waters. Image courtesy of Joe Laurence/Seychelles News Agency.

What you can do

Support ‘Fighting for Wildlife’ by donating as little as $1 – It only takes a minute. Thank you.

Đăng nhận xét